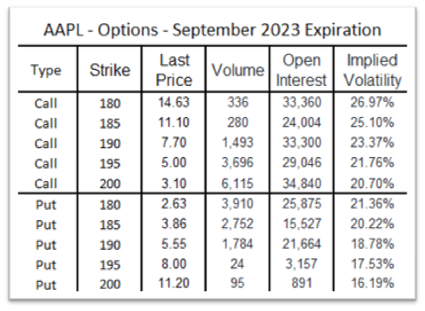

Sid: The options

table for AAPL stock is presented below, with the current trading price at $190

and an expiration date of September 15, 2023. Based on technical indicators, it

is clear that AAPL is overvalued. In such a situation, investors should

consider either selling covered calls to create cash flow or buying puts to

protect against a price decline. What do you suggest and why? It is imperative

to make a move now to avoid any potential loss.

ChatGPT: Based on

the options table, considering the overvaluation of AAPL stock, I would suggest

buying puts to protect against a potential price decline.

1. Put options give investors the right but not the obligation to sell the stock at a specific price (the strike price) before the expiration date. This provides downside protection as the stock price decreases.

2. The implied

volatility for the put options is relatively low, indicating that the market

expects less turbulence or uncertainty in the stock price leading up to the

September 2023 expiration. This makes buying puts more attractive as their

prices may be relatively cheaper.

3. In this

scenario, buying the put option with a strike price of 190, for example, would

provide protection if the stock price were to fall below that level. This would

limit potential losses and provide an opportunity to cash in on the downside.

It is important

to note that investing in options involves risks, and it is crucial to weigh

the potential gains and losses and consider one's risk tolerance before making

any investment decision.

Additionally,

it's worth considering that selling covered calls can also be a viable strategy

in an overvalued scenario.

1. Selling covered

calls involves selling call options on shares of a stock you already own (at

least 100 shares per contract) in order to generate income.

2. By selling

covered calls, investors can collect premium income from the option buyers,

which can help offset potential losses if the stock price declines.

3. However, in an overvalued situation like this, there is a higher risk of the stock price declining, which could result in the options being exercised and potentially limiting potential gains on the stock.

4. Therefore,

buying puts may provide a stronger form of downside protection, as it allows

investors to directly profit from a decline in the stock price, while selling

covered calls may involve more risk, as it relies on the stock price not

exceeding the strike price of the calls.

Ultimately, the

choice between buying puts and selling covered calls depends on the investor's

risk tolerance, investment goals, and outlook on the stock market. It is

necessary to carefully consider these factors before making a move to minimize

potential losses or generate income.

To sum up, based

on the options table and the overvaluation of AAPL stock, buying puts could be

a more suitable strategy to protect against a potential price decline. However,

both buying puts and selling covered calls have their own advantages and risks,

so it is important to thoroughly evaluate and consider one's investment goals,

risk tolerance, and market outlook before making a decision.

Sid: If an

investor is considering purchasing put options to protect against price

declines instead of selling covered calls, what option - at, in, or

out-of-the-money puts - would you recommend and why?

ChatGPT: If an

investor is considering purchasing put options to protect against price

declines, the choice between at-the-money (ATM), in-the-money (ITM), or

out-of-the-money (OTM) puts depends on their specific risk tolerance and

investment objectives.

1. At-the-money

(ATM) puts: These put options have a strike price that is closest to the

current trading price of the stock, in this case $190. ATM puts offer a

balanced approach as they provide a compromise between the cost of the option

and the degree of downside protection. They can be suitable if the investor is

looking for a moderate level of protection against a decline in the stock

price.

2. In-the-money

(ITM) puts: ITM puts have a strike price below the current trading price of the

stock. These options are generally more expensive than ATM or OTM puts but

offer a higher level of downside protection. ITM puts can be considered if the

investor has a higher risk tolerance and wants a stronger level of protection

against potential declines.

3.

Out-of-the-money (OTM) puts: OTM puts have a strike price above the current

trading price of the stock. These options are generally less expensive than ATM

and ITM puts but provide less protection if the stock price were to decline.

OTM puts can be suitable if the investor has a lower risk tolerance or wants to

limit the upfront cost of the option but is willing to accept a lower level of

downside protection.

Ultimately, the

choice between ATM, ITM, or OTM puts will depend on the investor's risk

appetite, investment objectives, and outlook on the stock price. It is

important to carefully consider the trade-off between the cost of the options

and the desired level of downside protection before making a decision.

In the given

options table, the put options with strikes of 180 and 185 are currently

in-the-money (ITM) as the stock price is at $190. These ITM puts provide

immediate downside protection and may be suitable for investors with a higher

risk tolerance and a desire for stronger protection.

On the other

hand, the put options with strikes of 195 and 200 are out-of-the-money (OTM) as

they have strike prices above the current trading price of the stock. These OTM

puts are less expensive but offer less immediate downside protection. They may

be suitable for investors with a lower risk tolerance who want to limit the

upfront cost of the options but are willing to accept a lower level of downside

protection.

Ultimately, the

choice between ATM, ITM, or OTM puts will depend on the investor's risk

appetite, investment objectives, and outlook on the stock price. It is

important to carefully consider the trade-off between the cost of the options

and the desired level of downside protection before making a decision.

Therefore, when

considering purchasing put options to protect against price declines, the

choice between at-the-money (ATM), in-the-money (ITM), or out-of-the-money

(OTM) puts will depend on the investor's risk tolerance, desired level of

downside protection, and investment objectives.

Sid: Options-approved

IRA accounts generally do not permit the purchase of Puts due to their

high-risk nature. However, Covered Calls can typically be sold. If an investor

is seeking to hedge against a potential decrease in the price of AAPL in an IRA

account, would you advise selling Covered Calls instead?

ChatGPT: Yes, if

an investor is seeking to hedge against a potential decrease in the price of

AAPL in an IRA account, selling covered calls can be a suitable strategy since

it is often allowed in options-approved IRA accounts.

Selling covered

calls involves selling call options on shares of a stock that the investor

already owns in their IRA account. By doing so, the investor collects premium

income from the option buyers, creating a cash flow. If the stock price remains

below the strike price of the sold call options, the options will expire

worthless, and the investor keeps the premium income as profit.

Here are a few

reasons why selling covered calls as a hedge in an IRA account could be

considered:

1. Income

Generation: Selling covered calls allows the investor to generate income from

the collected premiums, which can help offset potential losses if the stock

price declines.

2. Limited Upside

Potential: By selling covered calls, investors may limit their potential gains

if the stock price rises above the strike price of the sold call options.

However, in a potential downside scenario, the premium income from selling the

calls can partially offset the losses.

3. Lower Risk:

Compared to buying puts, selling covered calls generally involves less risk

since it relies on the stock price not exceeding the strike price of the calls.

This reduced risk can make it more suitable for an IRA account, which typically

has restrictions on high-risk investments such as puts.

4. Flexibility:

Selling covered calls allows investors to retain ownership of the underlying

stock while still benefiting from the premium income generated by selling the

calls. This flexibility can be advantageous in an IRA account, as it allows

investors to maintain their long-term investment position while potentially

generating additional income.

However, it's

important to note that selling covered calls does come with some risks and

limitations. For instance, if the stock price rises significantly above the

strike price of the sold call options, the investor may miss out on potential

gains. Additionally, if the stock price declines substantially, the income

generated from selling covered calls may not fully offset the losses.

As always, it's

crucial to carefully evaluate the specific circumstances, risk tolerance, and

investment objectives of the investor before implementing any strategy. Consulting

with a financial advisor is recommended to ensure compliance with IRA account

rules and to make an informed decision.

Sid: If an

investor is considering selling Covered Calls in an IRA account to protect

against price declines, what option - at, in, or out-of-the-money Calls - would

you recommend and why?

ChatGPT: If an

investor is considering selling covered calls in an IRA account to protect

against price declines, the choice between at-the-money (ATM), in-the-money

(ITM), or out-of-the-money (OTM) calls will depend on their specific risk

tolerance and investment objectives.

1. At-the-money

(ATM) calls: These call options have a strike price that is closest to the

current trading price of the stock, in this case $190. Selling ATM calls allows

the investor to collect a higher premium compared to selling ITM or OTM calls.

If the stock price remains relatively stable or declines, the options will

likely expire worthless, and the investor keeps the premium income.

2. In-the-money

(ITM) calls: ITM calls have a strike price below the current trading price of

the stock. Selling ITM calls allows the investor to collect a higher premium

compared to selling ATM or OTM calls, but it also carries a higher risk. If the

stock price were to rise above the strike price of the sold call options, the

investor may potentially face assignment and have to sell their shares at the

strike price. ITM calls can be suitable if the investor is willing to

potentially part with their shares at a specific price and still benefit from

the collected premium income.

3.

Out-of-the-money (OTM) calls: OTM calls have a strike price above the current

trading price of the stock. Selling OTM calls allows the investor to collect a

lower premium compared to selling ATM or ITM calls. However, OTM calls provide

a greater margin of safety as the stock price would need to rise significantly

above the strike price for the options to be exercised. If the stock price

remains below the strike price, the options will likely expire worthless, and the

investor keeps the premium income.

When considering

which option to choose, investors should factor in their risk tolerance and

expectations for AAPL's stock price movement. Selling ITM calls provides a

higher premium but carries the risk of potential assignment. Selling OTM calls

offers a lower premium but provides a greater margin of safety.

Sid: Investors

who prefer lower risk may want to sell out-of-the-money (OTM) calls, while

those who are willing to take on more risk may want to consider selling at-the-money

(ATM) or in-the-money (ITM) calls. What are your thoughts on this approach?

ChatGPT: I agree

with the approach of selling out-of-the-money (OTM) calls for investors who

prefer lower risk, while selling at-the-money (ATM) or in-the-money (ITM) calls

may be more suitable for those willing to take on more risk. Here's why:

1. Selling OTM

calls: Selling OTM calls can provide a greater margin of safety as the stock

price would need to rise significantly above the strike price for the options

to be exercised. This strategy allows investors to collect a lower premium but

offers a higher probability of the options expiring worthless, resulting in the

investor keeping the premium income. Selling OTM calls can be suitable for

conservative investors who prioritize downside protection and are comfortable

with potentially limiting their upside potential.

2. Selling ATM or

ITM calls: Selling ATM or ITM calls can provide a higher premium compared to

OTM calls, but it comes with a higher risk. If the stock price rises above the

strike price of the sold call options, the investor may potentially face

assignment and have to sell their shares at the strike price. This strategy may

be more suitable for investors who are willing to potentially part with their

shares at a specific price and still benefit from the collected premium income.

Selling ATM or ITM calls can be suitable for risk-takers.

It is recommended

that investors carefully evaluate their risk tolerance and investment

objectives before implementing any strategy. Consulting with a financial

advisor is also advised, especially for those trading within the limitations of

an IRA account, to ensure compliance with regulations and to make an informed

decision.

Data Sources: Yahoo Finance

Note: All conversations here are unedited. E&OE.

Note: ChatGPT is a registered trademark of OpenAI, and Bard is a registered trademark of Google.

No comments:

Post a Comment