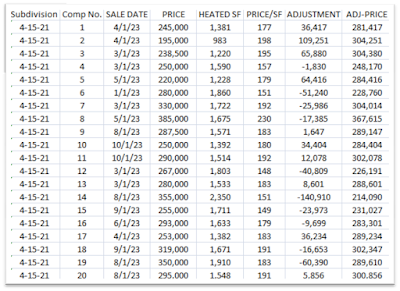

Sid: Using the following sales table comprising all 2023 sales, I have selected five comparable sales (comps) to determine the value of a subject property in the same subdivision. The subject property has heated square footage (HEATED SF) of 1,580. All the comps are not only extracted from the same subdivision, a PUD community, with identical land use and amenities, but they are also very similar in land sizes, year of construction, and construction quality. Additionally, these are all interior lots with very similar surroundings and views. To select the five best comps, I used the method of least price adjustments, ignoring signs, meaning I considered both positive and negative adjustments equal in value. Using this method, I calculated the least price adjustments by subtracting the HEATED SF of each comp from 1,580 and multiplying the result by $183, the median price per HEATED SF. Based on this calculation, I have selected five comps: 4, 9, 13, 16, and 20. The median value of these five least price-adjusted comps is $288,601, which is the estimated value of the subject property. Please review my methodology for selecting the comps and provide me with your analysis and opinion.

ChatGPT: Based on your

methodology for selecting the comps, it appears that you have focused on

finding properties within the same subdivision that have similar

characteristics to the subject property, including land size, year of

construction, and construction quality. Additionally, you have used the method

of least price adjustments to select comps, considering both positive and

negative adjustments as equal in value.

By calculating the least price

adjustments based on the difference in heated square footage between each comp

and the subject property, and multiplying it by the median price per heated

square footage, you have determined the adjusted prices for each comp. Then, by

taking the median value of these adjusted prices, you have arrived at the

estimated value of the subject property as $288,601.

Overall, your approach seems

logical and systematic, taking into account key factors such as the

subdivision, property characteristics, and price adjustments. The selected

comps provide a range of adjusted prices, allowing for a more accurate

estimation of the subject property's value. However, it is important to note

that this analysis is based solely on the provided data and methodology.

However, there are a few

considerations to keep in mind:

1.

Adjustments: While you have used

the median price per heated square foot to calculate adjustments, it's

important to note that this method assumes a linear relationship between square

footage and price. In reality, the relationship may not be perfectly linear,

and adjustments based solely on square footage may not capture all the

differences that could affect the value of a property.

2.

Timeframe: The sales data you

provided is from 2023, and the subject property's value is estimated based on

this data. It's important to consider if market conditions have changed since

then. Real estate values are influenced by various factors like location,

market trends, and economic conditions, so newer sales data may provide a more

accurate representation of the subject property's value.

3.

Sample size: While you have

selected five comps, a larger sample size could enhance the accuracy and

reliability of the estimated value. Ideally, a greater number of comparable

sales within the same subdivision and similar characteristics would provide a

more comprehensive analysis.

While your methodology appears to

be logical and considers important factors when selecting comps, it's always

recommended to consult with a professional appraiser or real estate agent who

can provide a more detailed and accurate valuation. They may be able to provide

additional insights or adjustments that could further refine the estimate.

Bard:

Review of Methodology for Selecting

Comparable Sales

Your

methodology for selecting comparable sales (comps) has several strengths and

weaknesses:

Strengths:

·

Focus on subdivision and property

type: Limiting your selection to the same subdivision (PUD community) with

identical land use and amenities is a good starting

point. Additionally, focusing on interior lots with similar

surroundings and views further strengthens your selection.

·

Median price per square foot: Using the

median price per square foot as the basis for price adjustments is a common and

reliable method.

·

Ignoring signs for

adjustments: Considering both positive and negative adjustments equal in

value is appropriate, as it avoids introducing bias based on the direction

of the adjustment.

Weaknesses:

·

Limited number of comps: Selecting only

five comps may not be statistically sound, especially given the potential

for outliers influencing the median value. Aiming for 6-10 comps is

generally recommended.

·

Sole reliance on heated square

footage: While heated square footage is an important factor, other

property features like the number of

bedrooms, bathrooms, upgrades, and condition can also

significantly impact value. Considering these additional factors could

potentially lead to a different set of comps or adjustments.

·

Mechanical application of

adjustments: Simply multiplying the square footage difference by the

median price per square foot may not adequately capture the complexity of price

adjustments. Some adjustments, such as those for upgrades or

condition, may require a more nuanced approach.

Overall:

Your

methodology has merit but could be improved by considering a few additional

factors:

·

Increase the number of comps: Aim for at

least 6-10 comps to ensure a more statistically robust analysis.

·

Factor in additional property

features: Don't rely solely on heated square footage. Consider the

number of

bedrooms, bathrooms, upgrades, condition, etc., and

adjust accordingly.

·

Refine price adjustments: Apply

adjustments based on the specific characteristics of each comp, rather

than simply using a mechanical formula.

By

addressing these weaknesses, you can refine your comp selection and obtain a

more accurate estimate of the subject property's value.

Additional

Points:

·

It's important to document your rationale for

selecting each comp and the adjustments made. This transparency will

increase the credibility of your valuation.

·

Consider consulting with a professional

appraiser for a more thorough and accurate valuation, especially if the

property has unique features or the market is complex.

I

hope this analysis and feedback are helpful!

Sid: Would it be appropriate to

have a larger sample size and make more adjustments - beyond just the heated

area - for a community with a more diverse housing stock? For example, should

we consider factors such as land size, effective building age, construction

quality, exterior, view, etc.? If so, would a regression model be more statistically

significant?

ChatGPT: Yes, it would be

appropriate to consider a larger sample size and make additional adjustments

for a community with a more diverse housing stock. In such cases, factors

beyond just heated area, such as land size, effective building age,

construction quality, exterior, view, etc., can significantly impact the value

of a property.

To account for these factors and

make more precise adjustments, a regression model can be a valuable tool. A

regression model allows you to analyze the relationships between various

property features and their corresponding impacts on price. By collecting data

on a larger number of comparable sales and including a wide range of factors in

the model, you can determine how each factor contributes to the overall value

of a property.

Using regression analysis, you

can estimate the coefficients or weights for each factor and apply them to the

subject property's characteristics. This will result in a more statistically

significant and accurate estimation of its value.

However, it's important to ensure

that the data used in the regression analysis is relevant, reliable, and

consistent. If the data includes sales that are significantly different from

the subject property in terms of location, size, amenities, or condition, the

regression model may produce less accurate results.

In summary, for a community with

a diverse housing stock, a larger sample size and more comprehensive

adjustments, along with a regression model, can help provide a more

statistically significant and accurate estimation of the subject property's

value. Consulting with a professional appraiser or real estate agent

experienced in regression analysis would be beneficial in this case.

Bard: Absolutely! For a community

with a more diverse housing stock, adjusting your comparable sales analysis

(CSA) to account for various factors beyond just heated area is not only

appropriate but essential for accuracy and statistical significance.

Here's

why:

Larger

Sample Size:

·

With diverse housing options, relying on

a small sample of comps can be misleading. A larger sample (ideally 6-10

comps) increases the likelihood of capturing the range of values within the

market and mitigating the impact of outliers.

Multiple

Adjustments:

· Just focusing on heated area ignores other

crucial factors influencing value, such as:

o Land size: Larger lots typically command higher prices, especially in areas with limited land availability.

o Effective building age: While year of construction provides a starting point, consider renovations, upgrades, and overall condition for a more accurate reflection of actual age.

o Construction quality: Higher-quality materials and construction methods generally translate to higher values.

o Exterior: Factors like architectural style, siding material, and curb appeal can influence market perception and price.

o View: Scenic vistas or desirable natural features can significantly increase value.

Regression

Model:

·

Regression models can be more statistically

significant than simply calculating median values, especially when dealing

with multiple adjustments. These models analyze the relationship between

sale prices and various property characteristics, providing a more nuanced

understanding of market dynamics and potentially revealing influential factors

you might have missed.

Benefits

of More Adjustments and Regression:

· Increased accuracy: By considering numerous factors and their impact on value, you generate a more accurate estimate for the subject property.

· Reduced bias: A larger sample and comprehensive adjustments minimize the influence of individual comps and personal biases.

· Stronger justification: Documenting the rationale behind each adjustment and using a statistical model strengthens your valuation report and bolsters its credibility.

However,

keep in mind that adding too many adjustments can lead to overfitting and

reduce the model's generalizability. Aim for a balance between

comprehensiveness and practicality.

Final

Thoughts:

For a

diverse housing community, embracing a larger sample size, multiple

adjustments, and potentially a regression model are excellent ways to ensure a

robust and accurate CSA. Remember, the goal is to capture the unique

characteristics of the market and the subject property to arrive at a reliable

value estimate.

Sid: You indicated, "keep in mind that

adding too many adjustments can lead to overfitting and reduce the model's

generalizability." How does an analyst avoid overfitting a model?

Bard: Avoiding overfitting in a

regression model used for comparable sales analysis is crucial for ensuring

your value estimate's accuracy and generalizability. Here are some strategies

to achieve that:

Data

pre-processing:

·

Feature scaling: Standardize or

normalize your data to prevent features with larger scales from

disproportionately influencing the model.

·

Dimensionality reduction: Techniques

like Principal Component Analysis (PCA) can be used to identify and eliminate

redundant or irrelevant features, reducing the complexity of the model and

mitigating overfitting.

Model

selection and training:

·

Start with a simple model: Begin with a

model with fewer coefficients like Linear Regression and gradually increase

complexity, monitoring for overfitting.

·

Regularization: Techniques like L1 or L2

regularization penalize complex models, discouraging overfitting.

·

Cross-validation: Divide your data into

training and validation sets. Train the model on the training set and

evaluate its performance on the unseen validation set. This helps assess

generalizability and prevent overfitting on the training data.

·

Early stopping: Monitor the model's

performance as it trains. When the validation error starts

increasing, stop training to avoid overfitting.

Evaluation

and analysis:

·

Analyze residuals: Plot the residuals

(differences between predicted and actual values) to identify patterns and

potential outliers.

·

R-squared and adjusted R-squared: While

high R-squared might seem ideal, adjusted R-squared penalizes for added

features, giving a more accurate picture of model fit while accounting for

overfitting.

·

AIC and BIC: Use information criteria

like Akaike Information Criterion (AIC) and Bayesian Information Criterion

(BIC) to compare models and penalize complexity, favoring simpler models

that avoid overfitting while maintaining good fit.

Remember,

there's no one-size-fits-all solution. The optimal approach depends on your

specific data and model.

By

utilizing these strategies and carefully monitoring your model's performance,

you can effectively navigate the trade-off between model complexity and

overfitting, ultimately achieving a statistically sound and generalizable

valuation through your comparable sales analysis.

Note: All conversations here are unedited. E&OE. ChatGPT and Bard are registered trademarks of OpenAI and Google, respectively.

No comments:

Post a Comment