In the fast-paced world of financial markets, quantitative analysis plays a crucial role in informing trading decisions and strategies. Regression analysis is a powerful tool in a quantitative trader's arsenal, which allows for exploring relationships between variables and predicting future outcomes. This blog post delves into the realm of regression analysis using the weekly closing prices of the S&P 500 index as the dataset. By leveraging regression output and statistical measures, valuable insights into market trends are uncovered, along with an exploration of how traders can use confidence limits derived from regression analysis to reinforce their short-term trading strategies. This journey bridges the gap between statistical analysis and practical trading applications in the dynamic world of finance.

Why Linear Regression?

When quantitative traders are primarily

interested in forecasting the S&P 500 closing values based on the passage

of time, it would be more straightforward to create a linear regression model

using only the "Time" variable (calculated as the number of weeks

since the weekly closings) against the S&P 500 closing prices.

In this case, traders will use Time as the

independent variable and the S&P 500 closing prices as the dependent

variable in the regression model. By fitting a regression model with Time as

the predictor, traders are essentially estimating the trend or pattern in the

S&P 500 closing prices as Time progresses.

Here's how traders can create the simple

regression model:

1.

The

dataset must be organized with Time as the independent variable (predictor

variable) and the S&P 500 closing prices as the dependent variable.

2.

A

simple linear regression analysis must be run with Time as the independent

variable and S&P 500 closing prices as the dependent variable.

3.

The

regression output should be examined to understand the relationship between

Time and closing prices, paying attention to the Time coefficient to

determine the change rate over Time.

4.

The

regression equation generated by the model must be used to forecast future

closing prices based on the projected time values. The time values for the

forecast period must be input into the equation to obtain the corresponding

forecasted closing prices.

5.

The

accuracy of the model's forecasts should be assessed by comparing the predicted

closing prices to the actual values once they are available for the forecasted

period.

By using a simple regression model with Time

as the predictor, traders can focus on the trend in the S&P 500 closing

prices over Time without the need for additional variables like Open-Close,

High-Low ratios, etc.

|

| (Click on the image to enlarge) |

Explanation of the Methodology

Here is a step-by-step summary starting from

the initial regression and then discussing how to utilize confidence limits for

trading strategies:

1. Regression Model Basics:

· Conducting

a simple regression analysis using the weekly closing prices of the S&P 500

from April 2024 to March 2025.

· Developing

a regression model using the weekly S&P 500 closing prices as the dependent

variable and Time (number of weeks since the weekly closings) as the

independent variable.

· Examining

the regression output: the coefficients for the Intercept, Time, and

statistical measures such as R-squared and significance levels.

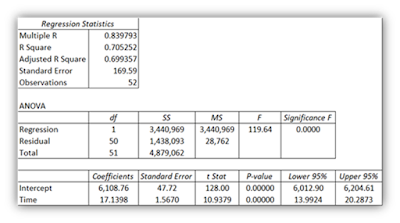

2. Regression Output:

· Intercept:

6,108.76

· Coefficient

for Time: 17.1398

· R-squared:

0.705252

· Significance

levels, standard errors, and other relevant statistical measures were examined.

· Regression

Equation: The core of the model is the regression equation: S&P 500 Price =

Intercept + (Time Coefficient * Time)

3. Forecasting Process:

· Inputting

Time: Using future "Time" values (0, 1, 2, 3, etc.) to represent the

next few weeks.

· Point

Forecast: A weekly forecast by plugging the "Time" values into the

regression equation.

4. Confidence Limits:

· Identifying

the lower and upper 95% confidence limits for the coefficients (Intercept and

Time) in the regression output.

· Lower

95% Confidence Limit: Indicating the lower boundary within which the actual

value of the coefficient is likely to fall with 95% confidence.

· Upper

95% Confidence Limit: Indicating the upper boundary within which the actual

value of the coefficient is likely to fall with 95% confidence.

5.

Applying Confidence Limits (Example):

· Week

1 (Time = 0):

o Lower Bound: 6108.76 + (13.9924 * 0) = 6108.76

o Upper Bound: 6108.76 + (20.2873 * 0) = 6108.76

o Range: 6108.76 to 6108.76 (In this case, the

range is the same because multiplying by 0 eliminates the effect of the

coefficient)

· Week

2 (Time = 1):

o Lower Bound: 6108.76 + (13.9924 * 1) = 6122.75

(approximately)

o Upper Bound: 6108.76 + (20.2873 * 1) = 6129.05 (approximately)

o Range: 6122.75 to 6129.05

· Week

3 (Time = 2):

o Lower Bound: 6108.76 + (13.9924 * 2) = 6136.75

(approximately)

o Upper Bound: 6108.76 + (20.2873 * 2) = 6149.33

(approximately)

o Range: 6136.75 to 6149.33

· Week

4 (Time = 3):

o Lower Bound: 6108.76 + (13.9924 * 3) = 6150.75

(approximately)

o Upper Bound: 6108.76 + (20.2873 * 3) = 6169.61

(approximately)

o Range: 6150.75 to 6169.61

By integrating the findings from the

regression analysis with confidence limits into trading strategies, traders can

implement a data-driven approach to managing risk and optimizing profit-taking

in their trading activities. This methodology emphasizes the importance of

combining statistical analysis with market knowledge to enhance trading

decisions in the short term.

Trading Strategy Implementation

Quantitatively savvy traders can use

the lower and upper 95% confidence limits as stop-loss and take-profit levels

for existing trades. These confidence limits provide a range within which the

actual values of the dependent variable (in this case, S&P 500 prices) are

likely to fall. Using these confidence limits as stop-loss and take-profit

levels can help traders set trade boundaries based on statistical

analysis.

Here's how traders could potentially utilize

the lower 95% and upper 95% confidence limits:

1. Stop-Loss Level (Lower 95% Confidence

Limit): If a trader is

holding a long position in the S&P 500, and the current price approaches the

lower 95% confidence limit (e.g., if the price is close to or falls below the

lower bound, it could signal a potential downside risk. In such a scenario, the

trader may consider setting a stop-loss order at or just below the lower limit

(similar to the technical support level) to limit potential losses if the price

continues declining.

2. Take-Profit Level (Upper 95%

Confidence Limit):

Conversely, if a trader is holding a position in the S&P 500 and the

current price is nearing the upper 95% confidence limit (e.g., close to or

above the upper bound) but is unable to breakout (similar to the technical

resistance level), it indicates a potential upside risk. In this case, the

trader may consider setting a take-profit order at or below the upper

limit to secure profits if the price reaches that level.

Using confidence limits as stop-loss and

take-profit levels can give traders a quantitative and statistically driven

approach to managing risk and locking profits. However, it's essential to

consider other factors, such as market conditions, trend analysis, and overall

risk management strategies, in conjunction with statistical analysis to make

well-informed trading decisions.

Suitability of the Strategy for Long-term Investors

While using confidence limits as stop-loss and

take-profit levels can be valuable for short-term quantitative traders looking

to manage risk and secure profits in the near future, their application may not

be as relevant for long-term investors with a different investment horizon and

approach. Here are some reasons why:

1. Time Horizon: Long-term investors typically have an

investment horizon ranging from several years to decades, focusing on the

fundamentals of the asset and its growth potential over the long term. In

contrast, short-term quantitative traders aim to capitalize on short-term price

movements based on statistical analysis and market trends.

2. Volatility and Noise: Short-term price fluctuations and

market volatility can cause the price to move within the confidence limits

frequently, leading to frequent stop-loss and take-profit triggers for

short-term traders. Conversely, long-term investors may be more concerned with

the overall trend and sustainable asset growth than short-term fluctuations.

3. Risk Tolerance: Long-term investors often have a

higher tolerance for market fluctuations and are willing to withstand

short-term price movements in anticipation of long-term gains. They may not be

as focused on setting precise stop-loss or take-profit levels based on

statistical confidence limits.

4. Fundamental Analysis: Long-term investors typically base

their investment decisions on fundamental analysis, focusing on factors such as

company performance, industry trends, economic indicators, and qualitative

aspects of the asset. Statistical confidence limits derived from regression

analysis may not directly align with the fundamental factors considered by

long-term investors.

In summary, while using confidence limits as

stop-loss and take-profit levels can benefit short-term quantitative traders

seeking to optimize trading strategies, it may not be the primary approach for

long-term investors focused on fundamental analysis and a buy-and-hold strategy

over an extended period. Each approach caters to different investment goals,

risk profiles, and time horizons.

Conclusion

In the trading world, the marriage of statistical analysis and

market knowledge can be potent for making informed decisions and managing risk

effectively. Exploring regression analysis and applying confidence limits as

stop-loss and take-profit levels sheds light on the intersection of quantitative

methods and trading strategies. By harnessing the insights gleaned from

regression output and confidently setting boundaries for their trades, traders

are better equipped to navigate the complex landscape of financial markets with

greater precision and confidence. As the discussion concludes, traders are

encouraged to embrace the power of regression analysis and statistical tools as

valuable resources in their quest for trading success. It underscores that

knowledge is power in quantitative trading, and data-driven decisions pave the

way to profitable outcomes.

Disclaimer:

The information provided in this blog post is for educational and informational

purposes only. While the content explores the application of regression

analysis and confidence limits in trading strategies, it is not intended as

financial advice or a recommendation for specific trading actions. Trading in

financial markets carries inherent risks, and individuals should conduct

thorough research, consider personal financial goals and risk tolerance, and

seek professional advice before making any trading decisions. Statistical

analysis and confidence limits in trading strategies should be cautiously

approached and may not guarantee successful outcomes. The author and platform

disclaim any responsibility for the outcomes of trading decisions made based on

the content presented in this blog post.

Sid's Bookshelf: Elevate Your Personal and Business Potential

No comments:

Post a Comment